Paytm & Insurance: A tryst with destiny

Decoding Paytm's move to acquire Raheja QBE (a general insurance company); why? and, maybe a bit on what's next!

Hi folks! Hope you’re keeping well - this week I’d like to deep-dive into Paytm’s move to acquire an Indian general insurance company. This marks a shift away from its previous strategy of an insurance distributor (which oddly seemed to be reinforced by the fact they got a brokerage licence in March ‘20).

Latest insurance news from Paytm

Paytm to announced its move to acquire Raheja QBE Insurance on 06/07 for ₹568 crore (i.e. $76.1M) [1] This deal is pending regulatory approval

Personally, the high Chinese ownership in Paytm could pose a problem (Indian insurance companies can have *at most* 49% foreign ownership). The acquirer here is Paytm founder Vijay’s SPV called QORQL Holdings (49% ownership) and Paytm itself (51% ownership).

For me, Paytm has been an interesting company when it comes to insurance; the graphic below will highlight their previous insurance ventures (can skip)

What’s next for Paytm & Insurance

Chances are you’ve heard the clarion call “What is Paytm’s business model?” - honestly, I don’t know but I can share my view on why they’d want to acquire a general insurance carrier.

1. Lifestyle insurance via Paytm First

Paytm First is analogous to a Amazon Prime-style play of bundling “value-add services” for Paytm users; more notable amongst their partners is GOQii. The wellness provider currently has 4 wearable-linked health insurance products in the IRDAI’s InsurTech sandbox (it’s fair to call them the “default provider” in my Q1 FY21 InsurTech update [2])

With its own general insurance company, Paytm might be able to roll-out wearable-linked health insurance as part of a higher-tier Paytm First offering (PS - I wouldn’t hedge my future on incumbents following through on this product innovation). But, that’s not all -

Paytm First has a Visa branded credit card! In the UK, Vitality has an AMEX card offering with cashbacks linked to physical activity (i.e. insurance + credit + health in one offering).

Paytm could easily integrate health insurance + credit + health + payments (maybe wealth management too?) into a single “bundle” via Paytm First - insurance written by Raheja QBE, credit via the Paytm First card and health via GOQii.

2. Motor insurance via Paytm Payments Bank

Paytm Payments Bank has issued ~4M FASTags (this is a sticker placed on windscreens for automated toll payments via an interoperable framework)

This implies that Paytm now knows not only which of its customers are drivers but also which customers are active drivers (albeit in “inner cities” only).

“Pay-as-you-drive” motor insurance is being piloted in the IRDAI InsurTech sandbox; these products are aimed at “weekend” drivers or “good” drivers. Again, don’t rely on incumbent carriers for product innovation!

Paytm could target the “weekend” driver segment via FASTag data. If nothing else, we know Paytm has a natural engagement point with drivers - could this be leverage to cross-sell (any form of) motor insurance via Raheja QBE? Methinks yes!

3. E-commerce focused insurance

In my piece on ZhongAn, I highlighted how big the e-commerce insurance (e.g. goods-in-transit, credit and white-label goods insurance) opportunity is. In the Indian context, it is best highlighted by Amazon’s investment into Acko!

Paytm has a number of commerce ventures:

Paytm Mall (e-commerce marketplace) ~ 100K sellers [3]

Paytm for Business (O2O2O commerce via Kirana & PoS stores) ~ 15M merchants [4]

Insurance products for MSMEs are yet to fully evolve in India:

Credit insurance is just being tested in the sandbox

IRDAI has recently launched a standard Fire & Allied Perils insurance product for MSMEs (this product was typically reserved for larger enterprises).

The “every Kirana store is an InsurTech company” theme is emerging via StoreKing & other pioneers.

In short, Paytm might use Raheja QBE like Alibaba used ZhongAn.

The weird - broker & insurer?

At first glance, folks wondered whether owning a broker & a carrier makes any sense. Well, this isn’t the first time I’ve seen a play like this - in Germany, WeFox (technology provider for insurance brokers) acquired digital insurance carrier ONE [5].

Effectively, owning a brokerage platform & your own insurance carrier creates a self-reinforcing product loop (i.e. discover gaps in the market and “learn” from other carriers).

That being said, Paytm would have to be careful about how it conducts business(other carriers might become suspicious) and there are certain regulatory aspects (which I will avoid).

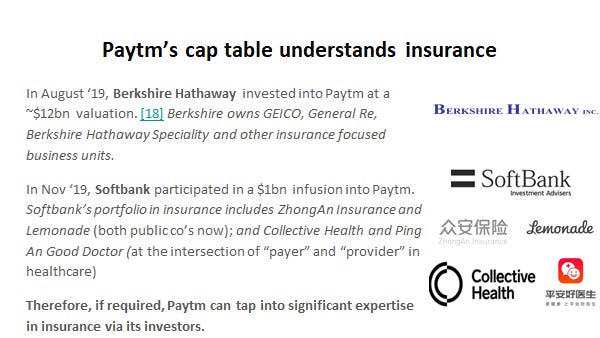

The last point I want to make: Paytm’s cap table has strong insurance pedigree - it can tap into expertise when required.

Closing thoughts

This deal is (as of 12/07) pending regulatory approval. Paytm doesn’t have a shortage of capital to run its own insurance carrier (with a $1bn infusion) and has broad distribution (~15M merchants and ~150M monthly active users) - the perfect ingredients for success as an insurance company.

Owing a carrier (given Paytm’s capital position) permits innovation on the product side of insurance (i.e. credit insurance, wearable-linked health insurance & “pay-as-you-drive” motor insurance) which is tricky to achieve as a broker (“skin-in-the-game” matters!)

In February 2018, Paytm registered “Paytm Life Insurance” & “Paytm General Insurance”; it has been a long journey since - can Raheja QBE become Paytm General Insurance?

If you found this useful, please do leave a Like and share it within your network. I look forward to your thoughts, comments and feedback.