Update on InsurTech in India (Q1 FY 21)

Drones, wearables, teleconsultation reimbursement & much more in this quarterly update on InsurTech in India.

Hi folks! It has been an action packed quarter for InsurTech in India - 49 pilots in the regulatory sandbox, fundamental product innovation (drones & wearables) and 42 circulars from the regulator (spanning e-KYC, telemedicine reimbursement & much more!)

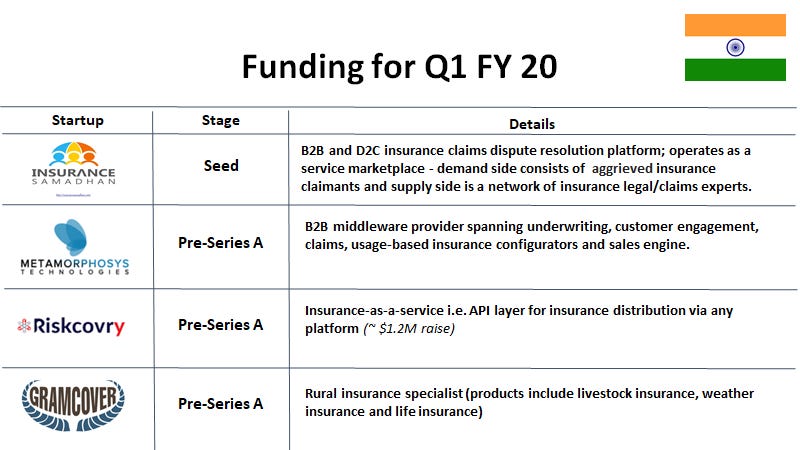

Funding

Aside from the companies mentioned above, Acko is expected to raise $60 million to $70 million at a valuation range of $400 million to $500 million from Munich Re Ventures. The $500 million price tag would value Acko at ~10x its trailing GWP (which was $52 million for FY20)..

Albeit this price multiple is much steeper than Digit’s x3 (i.e., $900 million valuation on $313 million GWP for FY20), I think Acko’s price multiple is justified; I shared my thoughts on the company in Blitzscaling Insurance with Acko.

Product Innovation

Quite broadly, innovation in insurance is split between innovation on the distribution (i.e., novel distribution channels, Acko x Ola, MobiKwik x Aegon Life, etc.) and fundamental product innovation.

If you are an Android user, definitely check out the Covid-19 insurance purchase journey in the Glance screen locker (powered by Riskcovry).

Acko’s pilot to experiment with tip-based contributions towards health insurance premiums for your Ola driver or Zomato delivery exec is an industry first

We’ll come back to drone insurance shortly but with the BVLOS (Beyond Visual Line of Sight) pilots under India’s “Digital Sky” initiative, the timing for drone insurance couldn’t be better!

Wearable-linked health insurance is quite the rage right now! And, it seems GOQii is the underlying hardware + wellness provider for every such pilot in India.

Pay-as-you-drive motor insurance is still in its nascent stages in India (compared to the UK and USA). The only product that impressed me was Edelweiss Switch (lovely quote interface and the product is priced on a per day basis rather than competitors who price in mileage bands i.e. they’ve got a more sophisticated product!)

A significant amount of product innovation is taking place under the IRDAI’s sandbox scheme (fun fact: 67 pilots will be running concurrently in July!); hence, looking to the regulator would be the natural step from here!

Regulation as an enabler

The Indian insurance industry tends to be rather conservative (i.e. ask for permission rather than forgiveness from the regulator). The regulator’s proactive approach (sandbox and recent announcements) seems to be the “permission to innovate” that incumbents have been waiting for!

Right off the bat, e-KYC is welcome. Traditional KYC costs ₹150; e-KYC via Aadhaar costs ₹20 (i.e., x7 improvement), which is a huge boost for micro-insurance & platform-led (low-ticket; high-volume) insurance sales.

Standardized MSME insurance for fire & other perils: Commercial insurance, as we know it today, tend to be “bespoke” policies (hence, typically available only to big corporates). This attempt at creating an “off-the-shelf” (and “all-inclusive”) insurance product can help with PoS (point-of-sale) distribution to small business owners (e.g. Kirana stores) - BharatPe might be pouncing on this opportunity!

Right off the bat, Tele-consultation is now reimbursable under health insurance (big win for the Tele-Health sector in India!)

The standard health and Covid-19 insurance products are double-edged swords - insurance companies hate it (competition on price) but customers, agents and platform distributors (e.g. Paytm) love it (ease of comparability).

Closely linked to standardized health insurance products is my thesis on where health insurance is headed in India:

Thesis - “UPI” of Health Insurance

My thesis here is that:

We’re seeing the insurance “product” get commoditized, i.e., we’re seeing standardization of:

Policy benefits

Definitions of exclusions

Claims handling

Arguably, the Arogya Sanjeevani policy (“standard health insurance product” from earlier) is a “bundle” of the above “standardized components.” Therefore, in health insurance, we're likely to see the basis of competition shift from “product” to “price” and “service.”

On “price”:

Hong Kong’s Voluntary Health Insurance Scheme (VHIS) is a good example of where we could be headed. They, too, have launched two standard health insurance products.

The VHIS has opened up an attack vector for digital insurance companies (e.g., Bowtie Insurance) to compete on a “level playing field” where “brand” matters less than “price.”

We’re already seeing a class of specialist micro-insurance players, e.g., InsureFirst, Gramcover, and BimaMandi, which are likely to benefit from this product owing to the “regulatory trust stamp” and simplicity it entails.

On “service”:

We’re seeing early signs of activity within the sandbox via GOQii in the wearables segment and telemedicine approval (possibly other digital therapeutics next?).

UPI is based on democratizing payments. The IRDAI recently permitted payment of health insurance premiums in installments (monthly, quarterly, bi-annually). This move will democratize access to insurance for weaker economic segments. Interestingly, the Bharat Bill Pay Service (BBPS), which focuses on recurring payments via UPI, is working on insurance premium payment as its next use case.

Closing thoughts

It has been an action-packed quarter for InsurTech in India led by regulatory action and accelerated by COVID-19. I’d like to leave you with the infographic below, highlighting the extent of activity in the ecosystem. From payments apps & existing InsurTechs supporting the distribution of COVID-19 insurance, we’ve seen three new startups emerge: Nova Benefits, BimaMandi, and ProtectMeWell!

And, that’s all from me! If you found this useful or informative, please do share it with your colleagues or friends. And, if you enjoyed this, please do leave a like or comment!

Update since publishing

The startup I co-founded — BimaPe — is now out of stealth mode. you can read a bit about what we are doing below.

Please note: Any views expressed above are my own and do not reflect those of BimaPe Inc, our investors, employers or customers.

About BimaPe

🏗️We’re building a consumer friendly digital insurance producton the India Stack (Account Aggregator, National Health Stack and UPI 2.0).

🧐You can discover hidden insurance benefits on your card here (no card number required) with BimaPe; join 4,500+ BimaPe members today!

📝You can subscribe to our daily Insurance Snapshots on WhatsApp here; join 1,800+ subscribers!

👶x5 open roles here.

‘Know Your Card’ by BimaPe is a tool for YOU to discover hidden insurance benefits on your card.

Great Insights

Great share!