Blitzscaling Insurance with ZhongAn

In 7 years, ZhongAn has gone from 0 to 486M customers serviced, $2.05bn in premiums and 8bn policies sold in a single year!

Hi folks! This post is a summary of a in-depth analysis I had conducted on ZhongAn last week (link here). The summary below won’t delve deeply into financials but will focus on core strategy and growth.

Introduction to ZhongAn

Founded in October 2013 as a Joint Venture between Chinese insurance incumbent Ping An, gaming giant Tencent and Alibaba Group, ZhongAn is a digital insurance company with operations in China, Hong Kong and Singapore.

ZhongAn operates (primarily) as a B2B2C “embedded insurer” and is famed for its ability to handle all logistics insurance products for Alibaba Group on its Singles Day shopping bonanza.

With regards to fundraising, in June 2015; ZhongAn raised a $930M Series A financing [1] and it went public raising $1.5bn in September 2017 via its IPO in Hong Kong. [2]

Growth

First up - ZhongAn has grown 179% YoY over a 5-year period (mind you - two of those years were as a public company!)

As you can see, growth does come at a price - whilst blitzscaling between 2016-2018, you can see the overall loss deteriorate significantly! Let’s try to understand what’s up here:

As an insurance company, it has 3 profit levers -

Expense Ratio (ratio of expenses to premiums collected)

Loss Ratio (ratio of claims paid to premiums collected)

Investment yield (investment income on premiums collected)

The aggregate statistics suggest that:

Economies of scale - Best depicted via the expense ratio - you can see the decline here coincides with the rapid scaling of top-line premiums in ‘17 & ‘18

Gradual increase in Loss Ratio - Partly driven by the nature of insurance claims (e.g. legal battles), it seems this spike in Loss Ratio in ‘19 is driven by Covid-19

Given by above comment on Loss Ratio, it would be incorrect if I didn’t highlight the composition of their (insurance) revenue

Let’s take a look at their “ecosystem” wise contribution

Ecosystem strategy (i.e. revenue mix)

Note - percentages mask the fact that in the above period, ZhongAn grew x2.125. However, there are some clear observations -

Health is a growth driver - grown from $168M in ‘17 to $672M in ‘19; and so is Consumer Finance - grown from $144M in ‘17 to $432M in ‘19; 3rd place to Lifestyle - grown from $250M in ‘17 to $522M in ‘19.

Incidentally, the Consumer Finance and Lifestyle ecosystems have been hit by Covid-19 (defaults galore) hence the adverse Loss Ratio in CY ‘19!

Public safety announcement - look at travel insurance below (86.5% of premiums paid by you, the consumer, got paid to ZhongAn’s partners as commission!!)

In no way am I insinuating that you shouldn’t buy insurance but I want to point out one InsurTech myth:

Repeat after me, “off-loading” or “zero” CAC in Financial Services exists if & only if you own a platform that drives unprompted user engagement.

Proponents of B2B2C InsurTech have chastisted D2C InsurTechs for “marketing spend”. Well, you can see above that in the B2B2C world, “marketing spend” is replaced by “channel fees”.

For those of you who might be keen to look at the “insurance” side of ecosystem, the graphic below should be interesting:

Again, look at travel insurance - out of every $100 paid by customers, only $7 is disbursed back in the form of claims (and, previously, we saw $86.5 went to channel partners)

If nothing else, the above graphic suggests that Consumer Finance was certainly badly hit by Covid-19 (orange line)

Enough with the boring insurance stuff; let’s move to ZhongAn’s Technology business

Technology

As you can see below, ZhongAn’s “core” business (i.e. insurance) is marginally profitable - its Health and Technology business are loss drivers (albeit a $89M net loss on $2.05bn in revenue is “small”)

However, the Technology business has grown rapidly - x3 in the past year with only a 42% increase in expenses

The high gross margin nature of Technology revenue (together with the fact that “capital expenditure” on software development will be low i.e. in-house Tech being commercialized) gets me excited - I think Technology will be a future growth driver.

But, at what cost?

ZhongAn has been severely penalized in the public markets - its share price tanked from $12.08 in October 2017 to an all time low of $2.16 in August 2019. In 2020, this shouldn’t surprise you given the market response to WeWork, Uber and other loss making “unicorns” together with the fact that ZhongAn continues to report a net loss.

In the “growth” graphic, it appears as if ZhongAn might be treading towards profitability (improvement in ‘19). However, we didn’t look at investment income!

In brief, the surge in investment income (~ $148M increase) is a driver of better financial results in ‘19. However, a closer examination suggests Dividend income (likely to be erratic under current market conditions) was the underlying driver.

Final verdict?

Well, despite my comments on ZhongAn’s “fragile” position in public markets, I think ZhongAn remains a company I hold in high regard.

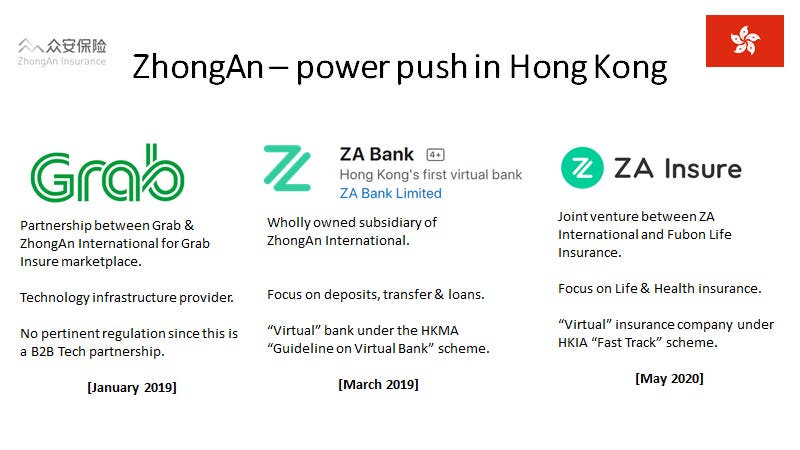

I want to leave you with a parting image - ZhongAn isn’t just an insurance company in China - they own a digital bank & digital insurer in Hong Kong. Both these units are likely to require “investment”

With depressed investment income likely (due to Covid-19) and ZhongAn’s “investment” into new units, I remain uncertain as to whether ZhongAn will manage to eek out net profitability in 2020 - how will public markets react?

“Markets can remain irrational longer than you can remain solvent.” - John M Keynes

I hope you enjoyed this read on ZhongAn; if you’ve got any questions, comments or feedback, feel free to reach out to me on Twitter @Rahul_J_Mathur

If you found this useful, please do leave a like and do share it widely!