Hello folks! I intently tuned into the Reliance Industries AGM on 15th July hoping to hear about Jio’s rumoured financial services foray.

“Using these technologies, we can create compelling solutions across multiple industry verticals like media, financial services, education, healthcare,..” - Mukesh Ambani - Chairman of Reliance Industries [1]

Sadly, the statement above was the only reference to Jio & Financial Services.

Jio has raised $20bn in the past few weeks [2] Prior to this fundraising spree, Jio had accumulated $6.3bn in debt [3] – most of which was attributed to infrastructure expenditure to support Jio’s network (which was adding 600,000 customers per day!)

You are sure to find a number of pieces on Jio; but I’d like to be very focused on my discussion around Jio x Insurance

I’ll begin by decoding what Jio represents before jumping into Jio x Insurance.

The “Jio stack”

Jio’s “ecosystem” goes deeper than any other in the world. Several infographics highlight the “India stack” but conveniently forget that the entire stack is built on network and hardware layer infrastructure – precisely what the Jio network and Jio’s (feature) phone provide.

There are some points to decode here:

Jio’s “ecosystem” play is much deeper than *any* other “super-app” aspirant (including WhatsApp)

Ask yourself this question – “What does the average joe need to access WhatsApp?” – no surprise, mobile network and a mobile!

Therefore, unlike any other “super-app”, Jio controls the access point to any digital ecosystem for its 369M customers [4] (~ 30% of the Indian population)

Some may argue network switching costs are low, but in a base case, Jio controls the digital access point for 70M users (the number of Jio phones sold until 10.2019 [5])

So, while WhatsApp was touted as the WeChat of India, Paytm launched its “Mini-Programs” ecosystem in 05.2020, Jio isn’t competing at the “application layer” – this will make more sense after examining the next point.

Jio has an Account Aggregator license

Pause here for a second – for 70M odd customers, Jio not only is their gatekeeper to the digital world but also is likely to become their “financial advisor”

Jio is double squeezing the India stack

For those of you familiar with the “narrow waist of the Internet” concept [8] – the India stack resembles that exact narrow waist – allowing for multiple networks at the bottom and multiple applications at the top.

A typical super app would impose downward pressure on the “narrow waist” but Jio imposes both a downward pressure (via the KaiOS app ecosystem / JioGenNext accelerator push [9]) and an upward pressure (via the hardware and network layer)

I think over time, this pressure will collapse into a “Jio stack”

Aviral & the Junior VC team succinctly described this as “vertical integration” [10]; I’ve perhaps been too verbose. Thus, it shouldn’t surprise you that Jio has been assigned a $64bn valuation.

Jio x Insurance

By virtue of being a network operator, Account Aggregator and (arguably) an app ecosystem, Jio has several monetization opportunities via insurance. In this section, I will highlight 4 potential operating models.

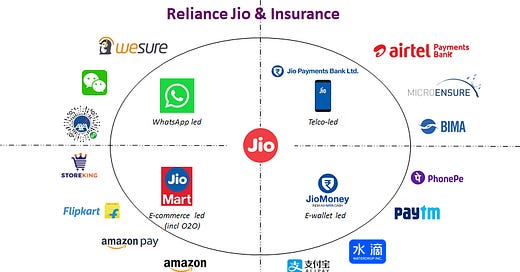

The infographic below highlights the operating models

1. Telco-led insurance distribution

The “freemium” model used by Joint-Ventures between Telco’s & insurance companies is well documented. Let’s begin by examining some facts about this model and the Indian context:

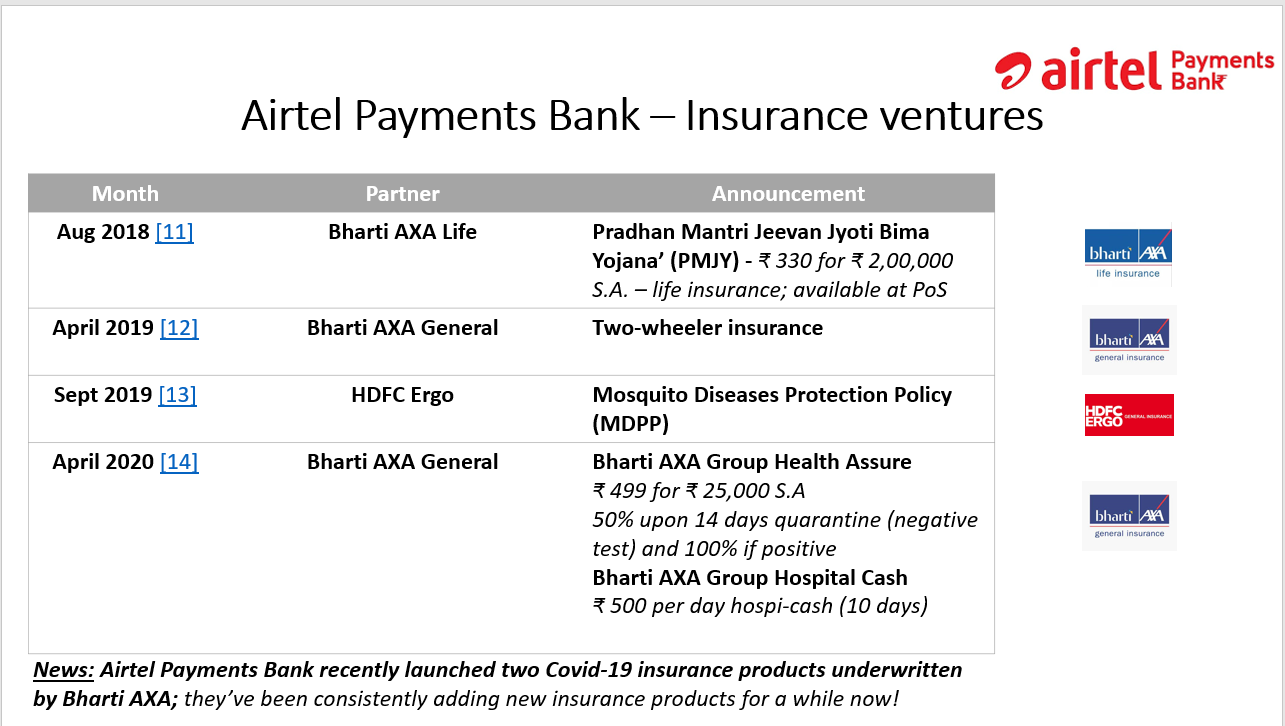

Airtel serves as a current example of this freemium model [11]

Free ₹2,00,000 term life insurance cover (underwritten by Bharti AXA Life) for all its customers availing of the ₹179 prepaid bundle.

Free ₹4,00,000 term life insurance cover for customers of its ₹ 599 prepaid bundle.

That’s a lot of free stuff; Airtel Payments Bank [12] offers a range of paid-for insurance products to its customers (completing the “freemium” aspect)

At first, you may think that as a network operator, Jio would require a payments bank license for the “freemium” insurance model to work (which it has via Jio Payments Bank since 2018). Even if Jio were just a Telcom network (which we know it isn’t), there are case studies to guide us as to how the “freemium” model would work:

International case studies for the “Telco x Insurance company operating model”

Bima [13]

Founded in 2010, Bima is a mobile-led insurance distribution specialist; with 35M customers.

Bima is backed by Allianz Group (via their investment vehicle Allianz X) and supported by Hannover Re (for reinsurance purposes) [14]

Bima has also moved beyond (health) insurance to telemedicine via its m-Health service (roughly 2.2M customers)

By focusing on product design and distribution; Bima helps both their underwriting partners (insurance co’s) and Telco companies.

MicroEnsure

Founded in 2002, it is arguably the original micro insurance specialist with 56M customers.

With backing from AXA Group and the International Finance Corp [15], MicroEnsure works actively with wallet providers & Telco’s in Africa and SE Asia; feel free to read their extensive case studies in Africa!

Back in 2015, Telenor India (now, Bharti Airtel) partnered with Shriram Insurance and MicroEnsure to offer up to ₹50,000 in free life insurance cover [16]

Jio’s role in the above “freemium insurance operating model” comes into question – is it only the network provider? Or, would it also play a “design” role w.r.t the insurance products being sold?

There isn’t an easy answer here, but India is a unique market:

Design support: InsurTechs such as Toffee Insurance, InsureFirst etc specialize in designing “sachet” insurance products that could be bundled into pre-paid Jio data plans.

Platform support: There even remains a question as to whether any design support is required! Infrastructure providers such as eBaoTech and Riskcovry allow any insurance company to offer plug-&-play products; alternatively – Acko Insurance could do product design and underwriting.

However, it would be incorrect for me to not highlight past issues with telco-led insurance distribution.

Battle scars

You won’t find detailed articles in the public domain about this insurance model in India; having spoken to micro-insurance veterans, there were issues in the past with regulation.

Further, there isn’t any public information about the success of these “embedded insurance” schemes (do customers know what they’re buying? Do they understand the claims process?)

Also, absence of Bima’s operations in India tells you something.

However, some of these challenges might be sidestepped when the IRDAI’s Micro-Insurance commission publishes its draft changes to regulations; you can read about it here [17]

To summarize, Jio could adopt the standard “freemium insurance” operating model used by Telco’s in emerging markets; the presence of “design” and “infrastructure” partners in India would make this a rather simple roll-out process (especially since it has locked-in distribution with 300M+ network subscribers).

2. JioMart (or O2O commerce)

Yes, you read that right – JioMart could be the perfect platform for insurance distribution. Before you jump to the comments section to call me an idiot; let’s review some insurance related activity by e-commerce firms in India:

Amazon

Amazon’s foray into insurance in India was clear with their strategic investment into Acko Insurance ($13M Series B); Acko provides the insurance you can opt-in for when you purchase you iPhone on Amazon! [18]

Unknown to many, AmazonPay has composite corporate agency license in India to distribute insurance products.

An insurance aggregator simply requires locked-in distribution. Unlike web aggregators, Amazon is a unique position where customers naturally flock to their platform for e-commerce (no SEM spend!); you could argue JioMart might see something similar..

Flipkart

Flipkart recently made its foray into insurance by partnering with Aegon Life in 03.2020 to sell life insurance [19]

Here are some thoughts on JioMart as a platform for insurance:

The “Flipkart” insurance model (pure genius)

Whilst Flipkart distributing life insurance sounds ridiculous, it is secretly genius – “the business model behind the business model”

eBaoTech’s InsureMo platform powers the integration between Aegon Life and Fipkart [20]

What you as a customer see is a by-product of Aegon Life and Flipkart’s true partnership – offering Group Life insurance to Flipkart’s network of wholesale retailers (and their staff members)

Furthermore, recent IRDAI regulations which mandate employer provided insurance coverage against Covid-19 could provide the right tailwinds for Flipkart to become the “commercial insurance broker” for its merchant network. [21]

If you pause for a few seconds – Flipkart’s foray into insurance reminds me of Ola Insurance and Grab Insure which operate as “insurance agencies” primarily focused on driver partners (and use them as “beta testers” before roll-out to their respective customer bases). Similarly, the “driver partner” analogue for Flipkart is its “merchant network”.

The “Amazon” insurance model (aggregation)

To be completely honest, e-commerce companies using preferred partnerships for warranties/goods-in-transit insurance is not new.

Personally, I think the “price aggregator” play (if any) would result from JioMoney and not JioMart; hence, let’s wrap this section up.

To summarize, JioMart could serve as a “platform” to sell insurance to its merchant network; like Flipkart’s current model which has parallels to the Ola Insurance x Ola and Grab Insure x Grab models respectively.

You’re half-way through - if you’d like to take a break - this is a good time! And, if you haven’t already, please do subscribe if you’re enjoying it so far:

3. WhatsApp as the lynchpin

You would have guessed that the Facebook x Jio partnership is centered around WhatsApp; from an insurance perspective, there are two opportunities:

“Kirana store as an InsurTech company”

Some of you may be familiar that JioMart has a strong offline presence which is augmented by its network of “Kirana stores” (i.e. corner shops). Post the Facebook investment, JioMart rolled out a pilot with 6,000 stores to test WhatsApp-based ordering. [22]

In an earlier post, I had highlighted how ShopKing and PayNearby Technologies are experimenting with this model. Some points to remember are:

The scope of micro-insurance products sold by PoS (Point-of-sale) agents e.g. Kirana store owners is set to expand (currently in review)

Based on the comments I received, there is a split view regarding the efficiency of Kirana stores to distribute insurance, the highlights were:

Insurance is a push product which requires guidance; Kirana store owners are used to pull purchases with little guidance.

Opportunity cost: Insufficient margin on micro-insurance product to justify the time spent to guide the purchase.

Educational/operational challenges: Would the Kirana store be able to support during the claims journey?

However, supporters of the Kirana store led distribution model highlighted that Kirana store owners provide a “layer of trust”. Despite their individual shortcomings, a centralized WhatsApp-first support center could be the missing piece in the puzzle.

Leveraging its O2O2O expertise could allow Jio (via JioMart and WhatsApp) to enable Kirana stores to become PoS distributors of insurance in India.

The WeChat Mini-Program model

WeChat’s mini-program ecosystem is widely known (think of this as an app inside an app; appception?) [23]With the Facebook investment into Jio, WhatsApp could become the “hub” in the “hub & spoke” model. I think WeChat’s mini-program ecosystem is well documented but there are two types of mini-programs – 1st party and 3rd party

1st party model

Tencent owned WeChat is the home of WeSure (Tencent’s insurance venture)

Launched in 2018, as of October 2019, WeSure has 55M customers [24]

WeSure is like Toffee Insurance/InsureFirst in that it “designs” & distributes insurance products underwritten by insurance companies. However, it differs in that WeChat is its sole distribution channel.

3rd party model

AXA Group owned AXA Go is a mini program that operates on WeChat. [25]

So, will Jio launch a “Jio Insure” mini-program on WhatsApp or will it just remain a 3rd party insurance play? I’d love to hear your thoughts

JioMoney (or WhatsApp Pay?)

To be honest, I don’t know what will happen to JioMoney after the Facebook investment – will it remain standalone from WhatsApp Pay (which already faces huge regulatory issues [26]) or whether WhatsApp Pay & JioMoney will merge

Either way, the Facebook investment into Jio makes me realize that the insurance category killer play might be lurking in plain shadows (hint: Xiang Hu Bao by AliPay i.e. mutual aid plays)

Mutual aid platforms are widespread in China; they bring back the old insurance concept of “mutualization of risks” (i.e. losses borne by members of a community are spread amongst the community members); now if you’re a sophisticated insurance professional, you know this is exactly what insurance does today, but, in a “black box” style.

Some international examples for you to review are:

Xiang Hu Bao by AliPay

Launched in October 2018, it got 20M customers in its first month.

With ~ 110M enrollees, Ant Financial anticipates that the “mutual aid” market in China to expand to 450M customers by 2025.[27]

Shuidihuzhu (Waterdrop Mutual) – a Tencent investee

Launched in 2016, it has 70M customers as per its website.

Unlike Xiang Hu Bao, Shuidihuzhu also has a crowdfunding (donation) platform and a traditional insurance brokerage arm.

Please note that the mutual aid structure might become “legal” in India subject to the IRDAI micro-insurance commission recommendations (2020); there are some technicalities (e.g. reinsurance stop-losses, organization structure, claims handling etc) which I will avoid in this discussion.

In India, the wallet-based insurance distribution model is finally emerging – Paytm is a leader; MobiKwik and PhonePe are not far behind. If you’d like to review my piece on Paytm & Insurance, do click below!

Specifically, by virtue of having the Account Aggregator license, Jio Pay would be able to “push” the right insurance products to its captive audience (i.e. income and spending based recommendations) and could perhaps become a version 2.0 of “price aggregation”.

To be completely honest, insurance in the context Account Aggregator framework is voodoo magic; but, if you find it interesting, I could write a separate piece

To summarize, Jio Pay could certainly foray into insurance via the “mobile wallet insurance” operating model since it is well documented in China with emerging examples in India. Further, its Account Aggregator license gives it an edge over most e-wallets foraying into insurance.

Conclusions

Hopefully this write-up has given you some context on Reliance Jio and (more importantly) the 4 operating models for Jio to explore in insurance. As a brief recap, the operating models are:

Telco-led insurance distribution

E-commerce led insurance distribution (via JioMart)

“Hub & spoke” centered around WhatsApp (both offline & online)

E-wallet insurance distribution (via Jio Pay or WhatsApp Pay)

Once again, the info-graphic as an aide-mémoire

I hope you found this piece useful/informative. I look forward to your thoughts, comments & feedback. Do leave a Like or Share if you deem it worthy! Until next time!

Disclaimer: My family and I hold an equity position in Reliance Industries Limited - Jio’s parent company. Please do not treat this piece as financial, legal or any other form of advice. Please obtain necessary counsel before making an investment decision; I am not liable for any financial or other loss incurred to you or to your associates as a result of statements made herein.

If you’d like to read a synopsis of my thoughts on Jio (outside of insurance), please do check out this Twitter thread below (I touch upon Healthcare as an area that has piqued my interest):