The 'NBFC for Insurance' in India

India's upcoming 'standalone micro-insurance company' framework - venture or impact opportunities? Maybe, both? It's time to insure 500M+ lives

Hey folks, hope you’re keeping well. InsurTech Tribe crossed 1K subscribers - thank you so much!

My team & I hopeful to come out of ‘stealth mode’ in a few days - apologies for being silent on this channel; I put out a Tweet offering our help to anyone confused about their insurance - honoured to be retweeted by Smt Latha Venkatesh.

In today’s edition, I will touch upon India’s proposed framework for standalone micro-insurance companies.

Broad context

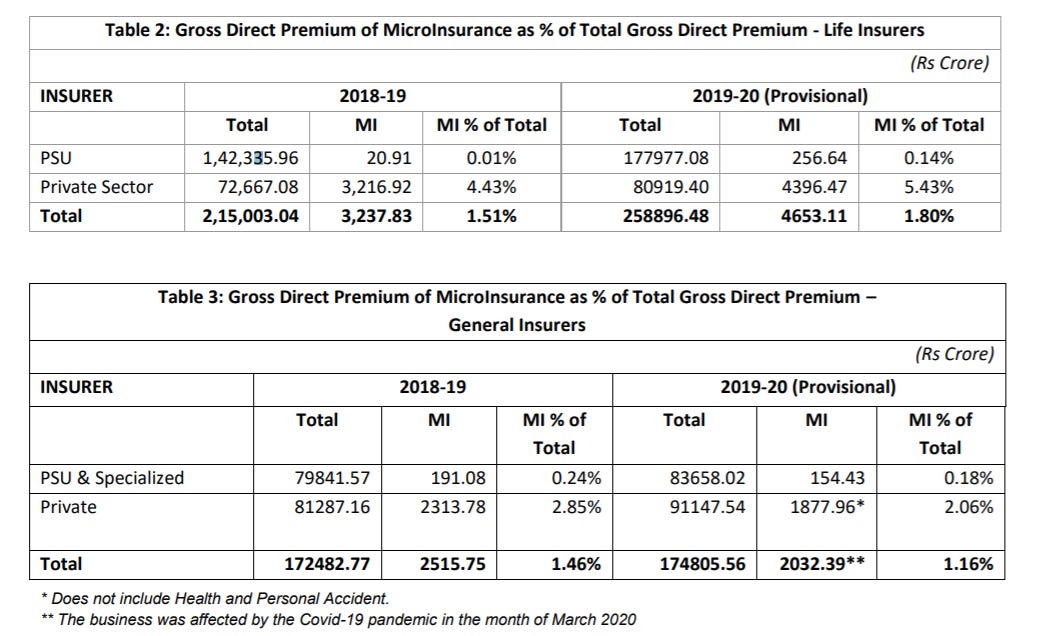

Per regulatory filings, Indian insurance companies cover 420M lives via micro-insurance products - this accounts for a measly 1.8% & 1.16% of the overall life & general insurance premium volume respectively.

I’d imagine some of you may jump at me. Yes, you’re right - these numbers sound crazy. But, recall that the Indian Government heavily subsidizes insurance for the lower income segments via the Ayushman Bharat programme, RuPay Card Insurance scheme and the Pradhan Mantri Jan Dhan Yojna (PM’s bank account creation scheme which offers free personal accident insurance of ₹ 30,000).

Micro-insurance v/s Social insurance

Quite often, micro-insurance is conflated with ‘social insurance’ (e.g. the NHS in the UK for Health & Ayushman Bharat Yojna in India). The IRDAI report provided a succinct explanation of the difference:

The differentiating factor between microinsurance and social insurance is the 'target market' and the ‘subsidy element'. Social insurance schemes are subsidized partially/fully by a third party, generally under a specific welfare mandate of the government.

With the broad context in mind and an understanding that ‘micro-insurance’ can be ‘for profit’ or ‘paid for’, let’s jump into what the Indian regulator is considering!

Summary of the proposed regulations

If you’re not a fan of a 133 page document, I’ve done some of the ‘grunt’ work for you. Below, please read “SAMI” as the standalone micro-insurer (the proposed entity)

Capital requirements reduced by x5: Proposed for SAMI = ₹ 20 Crores (i.e. $2.7M) v/s for insurance companies = ₹ 100 Crores (i.e. $13.5M).

Cooperatives can also apply for the SAMI licence.

So far, cooperatives have acted as distributors of micro-insurance products or created ‘risk sharing’ structures (i.e. community insurance).

This is a rare chance for larger cooperatives (e.g. AMUL - India’s ‘milk’ cooperative) to become risk bearing entities (at scale) - which allows them to design bespoke products (at more competitive) rates for their member base.

Setting up a Micro-Insurance Development Fund: Initial corpus of ₹ 50 Crores (i.e. $6.75M) with the objective of:

Extending ‘support’ to SAMIs (the parallel here is a credit guarantee scheme put for rural lenders by NABARD in India).

Providing technical & operational support to upcoming SAMIs (e.g. getting reinsurance capacity from large or overseas reinsurers at a reasonable price).

Overall, I was very impressed by the extent of research conducted by this working committee - so, what does this mean for you (the venture investor, the to-be-Founder..)?

Time for a short break; if you haven’t subscribed already, please do consider doing so.

What opportunities (don’t) exist?

“Microinsurance business means insurance business activity of providing specific insurance products that meet the needs of the disadvantaged for risk protection and relief against distress or misfortune.” - Proposed definition of microinsurance

Some VCs may be disappointed

Growth stage investors with whom I’ve spoken with lately were hopeful that the SAMI regulation would create the analogue to Japan’s Small Insurance licence (no jargon speak: create an restricted purpose insurance company with less regulatory capital).

To my best understanding, offering a short-duration trip insurance product won’t meet the above definition of microinsurance…

Right now, start-ups looking to undertake product innovation need to become insurance companies (e.g. Acko) or remain brokers (e.g. Plum).

Alternative asset investors may rejoice

“Existing insurers and others can become cell owners by bringing in capital and share the underwriting risk with SAMIs with a capital of no more than Rs 5 crore.”

Hedge Fund or Private Equity investors may have the opportunity to quasi-participate in insurance cash flows without actually being insurers!

The Protected Cell Company (PCC) structure may come into existence in India. It is a structure that allows a private investor to deploy ‘non-equity’ capital into the ‘extended’ balance sheet of an insurance company.

For my Indian audience, the ‘sidecar’ might be a new discovery. For my international audience, the concept of a reinsurance ‘sidecar’ may be commonplace - I’ll be happy to answer questions on this :)

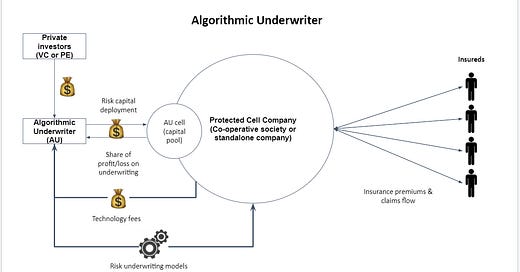

Enter the Algorithmic Underwriter (AU)

Think of an AU as a private capital backed technology entity that provides (a) risk modelling services & (b) technology services to a micro-insurance company.

To align incentives (“skin-in-the-game”), the AU buys into the ‘risk’ it is helping the micro-insurer underwriter (via the cell structure below). This ensures that any losses/profits on underwriting are distributed to the AU too.

The only downside is that this cell structure may ONLY be permissible for micro-insurance. Perhaps, not ideal for folks who want to insure on-demand mobility. But, exciting for folks who want to insure agriculture, livestock & other risks.

With a maximum threshold of $675K (or ₹ 5 Crores), I don’t see how AUs would be capable of pushing the needle but, worth a shot nonetheless.

The most likely candidates for the AU model would be micro-insurance focused entities like Gramcover (Pre-Series A) or foreign entities focused on weather/crop risk like Descartes Underwriting.

‘NBFC for Insurance’ parallel

An NBFC (Non-Banking Finance Corp) tends to be a specialist entity that works with banking partners to originate loans & other (banking-oriented) financial products for ‘non-traditional’ banking customers.

The AU is like the ‘NBFC for Insurance’ - focuses on a niche area of insurance, may even source customers directly (image below) but doesn’t hold full balance sheet risk.

A quick note for the ‘insurance nerds’ here:

You may think that the AU model resembles the ‘MGA’ - Managing General Agent model of USA & Europe. Yes and no - many MGAs don’t retain any risk on their balance sheet - they operate as brokers with pricing capability.

An AU is ‘retaining risk’ on its balance sheet since it is a cell owner - thereby, gets a share of the profit/loss on underwriting.

Closing thoughts

Personally, I think the SAMI framework is long overdue for grassroots organisations such as DHAN Foundation, Vimo SEWA and UpLift Mutual who are focused on empowerment of their members.

Private investors could look to back qualified teams for the AU model. However, they should be aware of the extended return cycles for insurance businesses.

I do look forward to your thoughts, comments & construction criticism. Feel free to drop a comment here or reach out to me @Rahul_J_Mathur.

Update since publishing

The startup I co-founded — BimaPe — is now out of stealth mode. you can read a bit about what we are doing below.

Please note: Any views expressed above are my own and do not reflect those of BimaPe Inc, our investors, employers or customers.

About BimaPe

🏗️We’re building a consumer friendly digital insurance producton the India Stack (Account Aggregator, National Health Stack and UPI 2.0).

🧐You can discover hidden insurance benefits on your card here (no card number required) with BimaPe; join 4,500+ BimaPe members today!

📝You can subscribe to our daily Insurance Snapshots on WhatsApp here; join 1,800+ subscribers!

👶x5 open roles here.

‘Know Your Card’ by BimaPe is a tool for YOU to discover hidden insurance benefits on your card.

Bite-sized takes on ‘InsurTech in India’

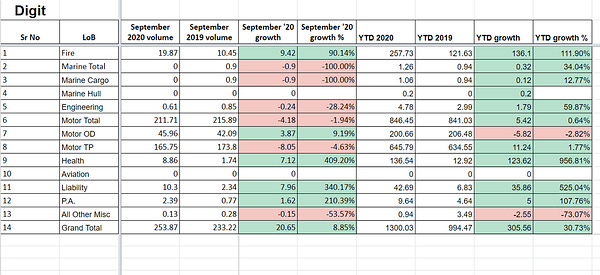

Digit Insurance killing it, per usual

Please, don’t fumble Acko!

Forgot to post this today.. Acko Insurance seems to be progressing well (despite Covid-19 pressures) 💸$20M premiums for FY 21 (down ~16% from FY 20) 🏥Health business really picked up in Sept $1.7M in health premiums (i.e. Acko is trading at ~x12 price:premiums right now)

Forgot to post this today.. Acko Insurance seems to be progressing well (despite Covid-19 pressures) 💸$20M premiums for FY 21 (down ~16% from FY 20) 🏥Health business really picked up in Sept $1.7M in health premiums (i.e. Acko is trading at ~x12 price:premiums right now)

Reinsurance startups raising funding

That’s all from me folks! Until next time (when we’ll be out of stealth mode)