InsurTech IPO - Root(ed) in reality

3 InsurTech IPOs in 1 year?! Root joins Lemonade & Clover Health (courtesy Chamath).

Hey folks! As a founder of a Pre-Seed InsurTech, I get very excited to hear about InsurTech IPOs. I briefly interacted with the Founder of Root over 2.5 years ago around the time I first discovered InsurTech.

In this installment, I will cover Root Insurance’s S1 filing.

Root Insurance

“Right now, today, our product is the worst it’s ever going to be.” - Alex Timm, Co-Founder & CEO of Root Insurance

About Root Insurance

Headquartered in Columbus (Ohio), Root Insurance is a juggernaut - in FY 20, it generated $526.9M in premiums and lost ~ $83.9M. The company has raised ~ $523M in equity financing (most recent funding was its $350M Series E valuing the company at $3.65bn). [1]

Anmol highlighted that you may be surprised to see the Gross Profit in the most recent quarter; given Root’s focus on motor insurance, this Profit is a by-product of lower claims (on account of Covid-19).

Commentary on IPO price

Per TechCrunch, Root is aiming for a $6bn valuation - a 64% markup to its valuation from about ~14 months ago. In my view, Root is on track for ~ $600M in premiums in FY 21; the proposed IPO price would reflect a x10 *forward* premium multiple.

This may seem like a generous price for a public insurance company. As at 08.10, Lemonade’s market capitalization of $3bn reflects a x25 *trailing* premium multiple.

Although Lemonade and Root cannot be compared (difference in insurance business), the above figures do serve as a guide for generous SaaS multiples applied to gross premiums generated by these companies.

For additional context, in India, Digit insurance is valued at x3 *trailing* premiums and Acko at x10 *trailing premiums* - perhaps, there is a ‘stateside’ premium?

Let’s move beyond ‘price’ to more interesting facts about Root Insurance -

Company data and S1 filing release

For a company incorporated in 2015, it has ~850 employees per LinkedIn data .

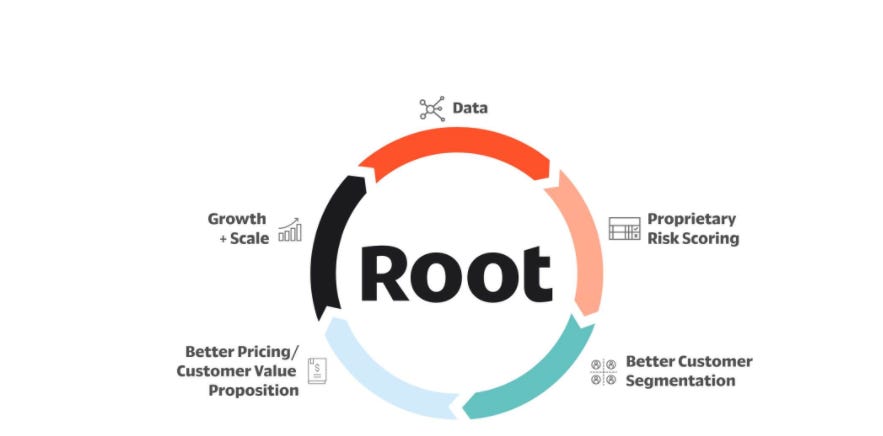

Root Insurance primarily sells telematics based motor insurance in USA - industry observers think this isn’t true - I won’t comment since I haven’t reviewed their pricing algorithms. Below is the “powerful flywheel” as per Root:

On 05.10.2020, Root Insurance filed its S1 with the SEC to go public. I went through the document and picked up some key statistics/observations for you to mull on:

Policies in force

For FY 20, Root’s motor insurance book grew 89% (i.e. nearly 2x) or an impressive 5.5% MoM growth for a late stage venture!

However, in Q1 FY 21, Root’s motor book did *not* grow! This shouldn’t surprise you given Covid-19; but there is another variable -

Root Insurance policies renew every 6 months - the plateau in growth of the motor book is driven by Covid-19 and *perhaps* drivers voluntarily letting their Root policy lapse (because they aren’t driving).

Root Re - vehicle of growth

Root Insurance retains ~15% of premiums on its own balance sheet i.e. it ‘cedes’ 85% of its top-line revenue to reinsurers (for context - Lemonade’s figure is 75% ceded to reinsurers).

Root launched its own reinsurance vehicle “Root Re” in 2019 to retain an additional 15% of premium it generates; i.e. Root now retains 30% of premiums.

How does this help Root? As shown below, the “loss cost” (i.e. % of premiums paid out as claims) incurred by Root is trending below 100% - therefore, by retaining more risk on its balance sheet, Root can increasingly dip into the insurance underwriting ‘profit’ on CAC it has already incurred.

Please note that the sharp drop in Loss Cost for Q1 FY 21 is certainly linked with Covid-19; however, in my view, the Loss Cost seems to be trending to a sub 100% level.

Beware of bundling

Root has expanded beyond its staple motor insurance into homeowners & renters insurance (ouch, Lemonade!)

Interestingly, the cross-sell rate of renters is trending towards ~7% over a 12 month period.

At first glance, this sounds terrific but its premium volume and not policies that drive revenue - the average motor premium is $909 versus a renters premium of $139.

Slightly technical: In a bull case scenario today, Root Insurance is *only* earning, on average, an extra 1% in premiums via cross selling renters insurance (i.e. 0.07 * $139 as a % of $909).

Churn

Root reports a 84% renewal rate at the end of the 1st 6 months and a 75% renewal rate at the end of the 2nd 6 months.

However, they do clarify that these figures could drastically change; cohort analysis is biased towards long time customers (who only account for ~47% of their customer base today).

To sum up my analysis, for a 5 year old company, Root Insurance has performed incredibly well to generate > $500M in premiums in FY 20. Investing in Root would be a bet on the retention and up-sell trend compounding over the next ~5 years.

Small break here - if you have enjoyed the read so far, please do consider subscribing to InsurTech Tribe, if you haven’t already:

In brief: Clover Health

Clover Health (USA Medicare) will go public via Chamath’s $IPOC SPAC (special purpose acquisition company); you can find Chamath’s thesis here:

I had previously touched upon Clover Health in connection with Google’s insurance investments. For Google, its insurance investments might just be a home run - Lemonade’s IPO has taken place, Clover Health will IPO via $IPOC and Oscar Health is expected to IPO in 2021 as per Axios. [2]

I will cover Clover Health in more detail in the next post. However, I am very excited to see that Root, Lemonade and Clover Health will go public in 2020 - that’s 3 InsurTech IPOs this year- liquidity for investors, founders & employees means that more money will pour back into the ecosystem for harder problems.

And, that’s all from me for this week - if you found this post interesting, please do consider dropping a ‘Like’ or sharing it forward. I look forward to your thoughts, comments & feedback.

Update since publishing

The startup I co-founded — BimaPe — is now out of stealth mode. you can read a bit about what we are doing below.

Please note: Any views expressed above are my own and do not reflect those of BimaPe Inc, our investors, employers or customers.

About BimaPe

🏗️We’re building a consumer friendly digital insurance product on the India Stack (Account Aggregator, National Health Stack and UPI 2.0).

🧐You can discover hidden insurance benefits on your card here (no card number required) with BimaPe; join 4,500+ BimaPe members today!

📝You can subscribe to our daily Insurance Snapshots on WhatsApp here; join 1,800+ subscribers!

👶x5 open roles here.

‘Know Your Card’ by BimaPe is a tool for YOU to discover hidden insurance benefits on your card.

Bonus content:

Venture Capital is pouring into InsurTech; this week saw $61.12M committed (in the Tweet below, I omitted Riskbook’s $2.6M Seed round - apologies!)