India's Open Insurance Protocol

The launch of OCEN (India's open credit protocol) raises a question - "is insurance next?"

Hello folks! Sending this post to 400 of you - thank you very much for your support! I’ve recently started building on the India Stack (i.e. digital public infrastructure) so today’s post is dedicated to the Stack and how Insurance might be the next frontier

Context on the India Stack

The India Stack has been a work-in-progress since 2009 when UIDAI (the Aadhaar issuing authority) was founded. Aadhaar (identity card) was the foundation for successive “layers” of the India Stack to built.

The initial focus was on the “less” layer:

Aadhaar: presence-less layer

DigiLocker: paperless layer

UPI: cashless layer

In anticipation of adoption of the Personal Data Protection (PDP) bill being passed, volunteers at iSPIRT began work on a privacy first framework called DEPA (Data Empowerment & Protection Architecture).

As a framework, DEPA forms the bedrock for two important consumer use-cases:

Consensual sharing of financial information (via the Account Aggregator framework i.e. “Open Banking”)

Consensual sharing of health information (via the National Health Stack i.e. “Open Health”)

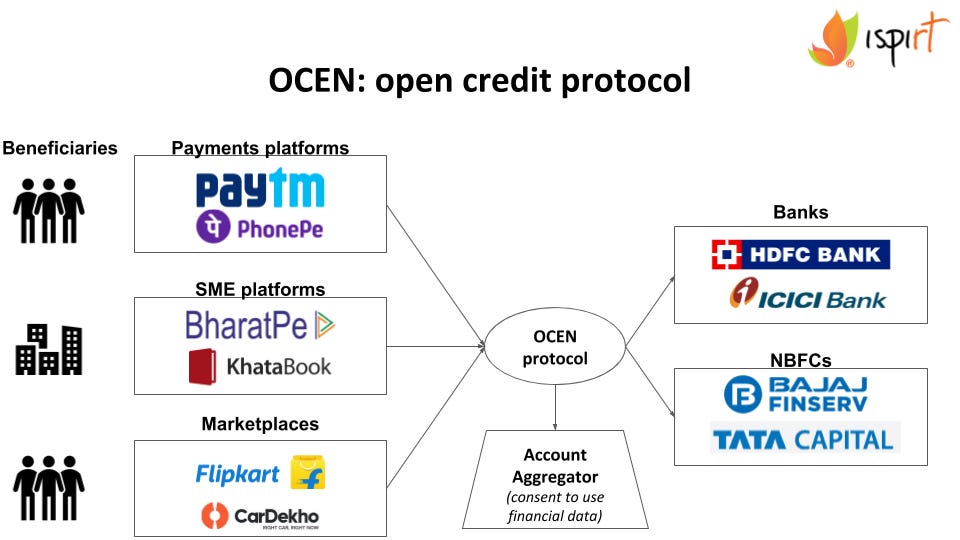

However, sharing financial information is a “tool” and not a “product” - on 25.07, iSPIRT announced OCEN (Open Credit Enablement Network) i.e. “UPI for credit” - an open protocol that acts as the “single API/integration for credit”. [1]

OCEN draws upon:

The Account Aggregator framework - to access financial customer data for:

Loan underwriting (decision to lend)

Loan monitoring (pre-emptive diagnosis of future NPAs to take corrective action)

End-use control (i.e. ensuring funds disbursed are used for the stated purpose)

The LSP framework

LSP stands for Loan Service Provider - a new class of entities focused on origination of loans on behalf of NBFCs (non bank financial corporations) and banks who offer the risk capital for lending.

LSP was a recommendation in the UK Sinha MSME report to the RBI (India’s central bank) [2]

Therefore, India has all the “building blocks” for open financial protocols. Credit now has its open protocol via OCEN - is insurance next?

Before we jump into the “UPI for Insurance '' - OPEN (Open Protection Enablement Network), it is important to review how OCEN is expected to operate to understand how OPEN & OCEN are likely to be very similar.

OCEN - India’s Open Credit Protocol

OCEN operates as a layer of APIs (Application Programming Interfaces) that standardize the loan disbursal, monitoring and collection process.

Please note that OCEN is relatively new - implementations have been discussed for MSME lending with a focus on (a) enabling vendors in the GeM (Government’s electronic marketplace for goods procurement by Govt departments) & (b) using the GSTN (Goods & Services tax number) for invoice discounting

Let’s walk through the loan origination process enabled by OCEN:

You select your new sunglasses from Lenskart (who has the LSP license).

When you arrive at the checkout screen, you have an opportunity to avail of a consumer loan. You select “Yes”..

You’re redirected to your Account Aggregator login & you give consent to Lenskart to query your ICICI bank account for

Details on your income/payments/assets etc (one-time)

Occasional access to assess your financial position (loan monitoring; optional)

Lenskart takes details regarding (a) Your financial position & (b) your purchase; these details get posted to the OCEN protocol.

Note: Lenskart won’t be able to “see” your data, it would share the location of & access keys to your data (as per your consent).

However, Lenskart may be able to monitor your payments/income flow (if you give consent for monitoring in return for a “better” quote)

17 banks respond with loan quotes i.e. interest rate and loan covenants (repayment structure, default criteria etc)

Lenskart collects these quotes & applies its discretion in showing you the top choices.

You make your choice (or don’t and just pay upfront!)

If you choose to pay your loan up midway through its lifetime, you have the opportunity to revoke your consent to let Lenskart monitor your financial statement too!

For further information on OCEN; do check out the iSPIRT blog.

Let’s pause here for a moment - OCEN is live; you can check the GitHub repo here. In the next half, I’ll share my thoughts on the insurance analogue to OCEN.

If you’ve enjoyed this read so far; and haven’t already, please do consider subscribing

OPEN - India’s Open Insurance Protocol

OPEN would operate as a layer of APIs to standardize the insurance underwriting, distribution & claims process. For technology platforms & consumer facing apps, OPEN would act as a “single API for insurance distribution”.

Let’s walk through the insurance sales process enabled by OPEN:

You decide to book a trip to Maldives on Yaatra.com (who has a corporate agency licence to sell insurance).

When you arrive at the checkout screen, you have an opportunity to avail of Overseas Medical cover for your trip; you say “Yes”

You’re redirected to a Consent Manager login & you give consent to Yaara.com’s insurance partner to query Apollo Hospitals for your medical records.

Your trip and medical details are posted to OPEN to collect insurance quotes regarding:

Premium payment (& structure)

Policy benefits, exclusions & value-add services

12 insurers respond with insurance quotes

Yaatra.com collects these quotes & applies its discretion in showing you the top choices.

You make your choice (or choose not to buy!)

If you want, you can get advice on your policy purchase from a qualified individual (e.g. insurance broker)

Matters such as claims handling and mid-term adjustment of policies are yet to be fleshed out. OPEN is as yet at the “concept stage”

Benefits of OPEN for the ecosystem:

For insurance companies,

Distribution arrangements typically occur via group products often involve a high degree of opacity on membership composition; leveraging the India stack can lead to a “fairer” pricing structure via:

Viewing PEDs of members (via the National Health Stack)

Viewing financial position of members (via Account Aggregator)

Access to new sources of distribution (technology companies can tap into different audience pools)

For distributors (or platforms)

No new regulatory structure is required since the existing corporate agency license is sufficient.

Access to the best commission rates by originating business for a broad range of carriers (no partner lock-in)

For customers

Better product selection (tailored to their needs)

Best price

On the Health side of insurance, iSPIRIT has been working on:

The National Health Stack (which includes an electronic claims switch) [3]

The Gamifier policy (a new kind of outcomes-based health insurance policy) [4]

It is likely that the combination of the Health Stack and Account Aggregator will enable a version of OPEN for health insurance in India in the coming years.

That’s all from me! I look forward to your thoughts, comments & feedback. If you’d like to discuss the India Stack/OCEN/OPEN etc in a bit more with me; please feel free to DM me @Rahul_J_Mathur

Interesting post-Rahul... Can banks or their subsidiaries act as LSP....IN other words, what are the criteria for someone to become LSP.. Currently, I guess Ispirt approved 6-7 players

Hi Rahul we are Corporate Agent and looking for building ISPIRT platform, Are we eligible in making it