A virtual InsurTech wave in Hong Kong

Unpacking digital-only insurance challengers in Hong Kong.

Hi folks! you might be familiar with Hong Kong’s acclaimed digital banking regime but its digital insurance regime is quite overlooked. Perfect topic to deep dive into, right?

What is a “virtual” insurance company?

Before anyone guesses that the above means a non-existent insurance company, I’ll jump right in to clarify: this is terminology used by the Hong Kong Insurance Authority (HKIA) to refer to digital-only insurance companies that have been licensed under their “Fast Track” scheme. [1]

The major components of the HKIA’s “InsurTech corner” are:

The InsurTech sandbox (for any novel insurance product innovation)

The “Fast Track” (for licensing digital insurance companies)

Rather than reiterate the HKIA’s succinct definition of what a virtual insurance company entails, I encourage you to read the blurb from their website below:

If you chose to skip the above (like most people do with regulatory documents) a virtual insurer is:

Subject to the same capital adequacy rules as traditional carriers in HK.

Only permitted to acquire customers via digital channels (i.e. omni-channel or O2O point-of-sale isn’t permitted)

Subject to ownership regulations for companies issuing multi-year policies:

Life insurance contracts are a great example of multi-year policies.

i.e. for life insurance ventures, a virtual insurer must have a shareholder with a significant (minority) interest who possess an insurance license in Hong Kong or an affiliate jurisdiction. You will observe this shortly!

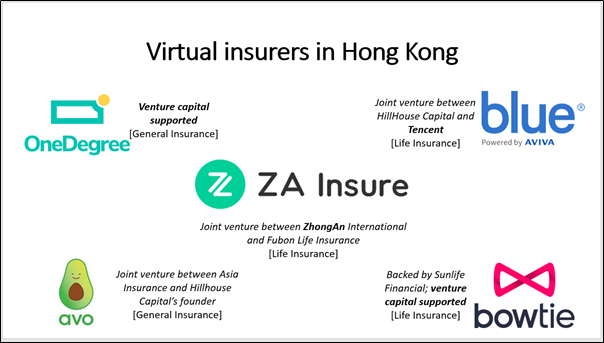

Now that we’ve glossed over the regulatory aspects of the virtual insurance licensing regime in Hong Kong, it’s time to examine the 5 players in this segment!

The landscape

If this is the 1st time you’ve come across the “virtual insurance” license, the table provided below will give you on overview of the digital insurance ventures in Hong Kong:

Blue

Blue was launched in September 2018 as a Joint Venture between Aviva, Tencent and Hillhouse Capital. Whilst Blue wasn’t granted a license under the “Fast Track” programme from the HKIA (owing to Aviva’s licensing arrangement), I believe it deserves a mention nonetheless.

Aviva’s role

Aviva’s participation was hotly debated in circles at the time given it had a strong Hong Kong presence and broker network. However, the presence of the broker network suggests why Aviva might have preferred “greenfield challenger” approach for a D2C play.

Blue would be a classic case of “veiled co-opetition” (wherein a challenger subsidiary “competes” on a functional basis with an established business unit). In Aviva’s case – Blue would (indirectly) compete against Aviva’s broker network.

Now, of course there is a valid argument that a digital play would cater to an audience that isn’t catered to by traditional brokers (i.e. migrants, millennials etc). There is another valid argument regarding the “graduation dynamic” of insurance customers – brought into the “Group” as millennials via digital channels (i.e. Blue by Aviva) & then retained through mid-life via high-touch broker services (i.e. Aviva’s broker network).

An important point: In the past, I’ve referred to Blue as “Blue by Aviva”; however, it would be incorrect to do so. In 11.2019[2] Aviva publicly confirmed the sale of its stake in Blue (~40% of the company) to Hillhouse Capital (who owned ~40% at the time).

Blue today (no longer by Aviva)

It should be noted that Aviva exiting Blue shouldn’t be viewed in a negative light since it is part of the group’s larger withdrawal from the Asian market. [3]

This means that Blue is now a JV between Hillhouse Capital (80% ownership) and Tencent (20% ownership); there are two brief points to unpack here:

a. Tencent’s has forayed into digital insurance on multiple occasions

ZhongAn (arguably the poster-child of InsurTech) began life as a JV between Tencent, Ping An Group and Alibaba.

Tencent launched WeSure in China to act as an insurance “app” on the WeChat Mini-Programs ecosystem. WeSure has 55M customers[4]

Tencent could look to enter insurance infrastructure vendor segment– what better way to learn what cloud architecture best suits digital insurance that to build for yourself? This is what Zhong An and Ping An have done with ZA International and OneConnect respectively. Blue is built on Tencent’s cloud infrastructure. [5]

b. Hillhouse is no stranger to InsurTech either

Since the Blue investment in 2017, Hillhouse Capital has aggressively backed InsurTech start-ups in Asia and the West.

Recent examples include CCCIS - China ($14M Series A) [6], Lima Technology - China ($28M Series A) [7] and Coalition – USA ($40M Series B) [8]

Awkwardly, Hillhouse Capital’s founder owns a 49% stake in Avo Insurance (which we’ll come to in a few moments!)

With Hillhouse Capital and Tencent at its back, Blue has only to look forward – it has had the advantage of an early start; but 1st mover advantages don’t exist in all industries!

With that dramatic finish above, let’s move to Bowtie – a virtual life insurance challenger.

Bowtie

As the 1st virtual insurance company to be granted a license, Bowtie made its big-bang announcement in 12.2018! It should be noted that Bowtie is partially backed by Sun Life; to date, Bowtie has raised $30M in funding.

Bowtie’s power push into health insurance

Typically, regulation is viewed as a “barrier” in insurance. In a rare case, Bowtie stood to benefit greatly from legislation in Hong Kong in 2019 – the launch of the Voluntary Health Insurance programme (VHIS)[9]

A common criticism levelled against new carriers is the lack of “brand” to stand out in a “differentiated insurance market” (well, I don’t think the market is differentiated but, okay!) However, when its down to a Government mandated product, brand doesn’t come into question. Therefore, the VHIS programme provided the perfect tailwind for Bowtie to launch itself into the Hong Kong health insurance industry.

Since “brand” was no longer the competitive dimension due to standardization of the VHIS product, competition automatically moved to “price” where Bowtie has a clear advantage of low overheads (no legacy infrastructure & no physical broker network).

Rather than have me highlight this to you; below is a screenshot from Bowtie’s websit

Bowtie’s VHIS focus

My only fear with Bowtie is its concentration on the VHIS scheme. Whilst they will diversify over time, the current pandemic might cause some short-term pain since the Hong Kong authorities clarified that the VHIS covers Covid-19 treatment costs. [10]

Since I’m not aware of their reinsurance arrangements and reserving approach, I won’t comment further on the down-side. But, on the up-side, the pandemic might create a surge in health insurance purchases by 1st time buyers - they’re more likely to buy a government proposed product (i.e. VHIS) and would be more price sensitive – Bowtie has an edge here!

Despite my comments on Bowtie’s VHIS focus, I remain bullish about their prospects in the health & life insurance segment; 2018 figures suggest 53% of Hong Kong’s population doesn’t have health insurance! [11]

Bowtie was HK’s 1st virtual life insurer; next to HK’s 1st virtual general insurer!

Avo Insurance

Whilst I’m sure Avo(cado) Insurance is a well-intentioned reference to the popular meme about millennial obsession with avocados, let’s ignore that for now. Avo Insurance is backed by Asia Insurance Group (51% holding) and Zhang Lei (Hillhouse Capital’s founder) with a 49% stake. [12]

“Avo’s business model is B2C while Asia Insurance is mostly B2B. Avo will directly sell products to customers. Asia Insurance’s direct clientele makes up less than 5 per cent, and most of its business comes from brokers and agents” – Winnie (CEO of Avo and Asia Insurance) [13] (Quote courtesy of South China Morning Post)

So unlike the case with Blue where I was speculating with the “veiled co-opetition” theory, in the case of Avo Insurance, the CEO has confirmed this theory for us! As highlighted earlier, this is a neat strategy – but, I am more fascinated by Mr Lei’s ownership in the company given Hillhouse Capital has a stake in Blue.

Avo’s lifestyle insurance push

Avo’s product line includes e-wallet insurance; travel insurance & cancer insurance. They launched a Covid-19 insurance product on 27th February[14] The Avo team kindly offered the insurance for free to frontline medical staff.

Whilst there remains an open question regarding the requirement for standalone Covid-19 insurance products (which have been hotly debated) – with ~50% of the population lacking any health insurance, some protection is preferable to no protection!

I wouldn’t be worried about an adverse loss scenario from their travel insurance products and Covid-19 product since Avo Insurance is likely to benefit from Asia Insurance Group’s strong reinsurance network (and financial support).

For those of you who’ve been through multiple “Tech waves”, Bowtie and Avo Insurance reminds me of the “ING Direct” parallel (here, the relevant parties would be Sun Life and Asia Insurance Group respectively)

The tale of Two (Sigma and Avo Insurance)

On 8th April 2020, Two Sigma announced an investment into Avo Insurance and their partnership on data science [a]. For those of you wondering what’s the fuss about Two Sigma, a “quant” (quantitative analyst) role at the firm is as prized as a software engineering role at Google HQ.

Two Sigma is no stranger to insurance; although a 10,000 ft view of the vehicle suggests it is a Hedge Fund, maybe the below will suggest a review of this view:

a. Two Sigma IQ (Insurance Quantified): A productized version of Two Sigma’s in-house data science capability applied to the insurance industry.

b. AIG partnership [15]– Two Sigma IQ is working with AIG; they had previously jointly invested into Attune (US commercial insurance).

Enough with the incumbent-backed challengers, let’s move to an “independent” challenger – OneDegree Insurance

OneDegree

“The best way to manage disruption is to be part of the disruption!”- Alex, co-founder of OneDegree

Unlike the previous digital insurers listed above, OneDegree is an “independent challenger” (i.e. it doesn’t have a significant minority ownership from an insurance incumbent). OneDegree announced its licence on 16th April 2020 [16]

What I find fascinating about OneDegree is that it chose to go into non-traditional insurance business – with pet insurance as a starting point. As co-founder Alex highlighted on the Asia InsurTech podcast, OneDegree began life as a technology provider – it discovered that the missing electronic medical record system for veterinarians provided the perfect wedge into the pet insurance market in Hong Kong! [17]

Since OneDegree is rather early in its journey as a virtual insurance company, it would be fair to revisit them at a later day to follow-up on their progress

With pet insurance penetration rate of 3% in Hong Kong [18], OneDegree will be a company to watch!

If you were hoping for more independent challengers, I’m afraid I will disappoint but I’ll highlight the “former challenger creating a new challenger” dynamic below with ZhongAn!

ZhongAn Insure

ZhongAn began life as a joint venture between Ping An Group, Tencent and Alibaba; it went on to IPO on the Hong Kong stock exchange in 09.2017[19]. Although a loss-making technology venture at the time, ZhongAn is now profitable for two straight quarters in its core insurance business[20].

The majority of focus on ZhongAn lies in their technical architecture – 10bn policies sold in 3 years [20]; most of which are logistics insurance (e.g. commerce shipping returns) products. However, ZhongAn has been working hard on commercializing its in-house technology via ZA International & ZhongAn Technology [22].

Partnership with Grab: ZA International provides the technology that underpins the Grab Insure platform; announced 01.2019 [23]

Launch of ZA Bank: The HKMA has issued digital banking licences to several parties; ZhongAn Technology was an early recipient of the licence in 03.2019[24]

Given ZhongAn has launched a digital bank in Hong Kong, it didn’t come as a surprise that they launched their digital insurance company on 4th May [25]. In true ZhongAn style, ZA Insure was live within days of this announcement (this could just be a case of a well-timed announcement but a review of ZhongAn’s audited CY 19 statements suggested the licencing hadn’t come through as on 31.12.2019).

Please note that ZA Insure is a Joint Venture between Fubon Life and ZhongAn

Digital bancassurance (or bancassurance 2.0)

Fancy words to describe the bancassurance affinity channel (i.e. partner-led distribution channel for insurance company) but, done via digital means. With ZA Bank, ZA Insure’s focus on Life, Cancer and Heart Attack insurance aligns well for a bancassurance partnership between ZA Bank and ZA Insure.

Given the target demographic of a virtual bank, ZA Insure might just be able to tap into ZA Bank’s customer base which has lower life insurance penetration than average. Nonetheless, Hong Kong has ~ 18% life insurance penetration (premiums as a % of GDP) in 2018 [26] so there is a lot of room for growth!

From a customer acquisition standpoint, ZA Insure and ZA Bank together could increase the CLTV (customer lifetime value) for a ZA Bank customer (at the “group” level i.e. for the parent company).

Again, it’s fairly early days for ZA Insure so let’s keep watching them progress! Next, on to some wrap-up comments & observations.

Observations on the virtual insurance regime in Hong Kong

Revival of the “greenfield challenger”

“Greenfield challenger” sounds very MBA (something I don’t possess) but derives from Professor Clayton’s Disruption Theory; quite often a parent organization is unable to innovate in certain respects due to organizational constraints.

In the context of insurance, companies are averse to D2C initiatives due to fears of upsetting their broker network (hence, price comparison websites have become the de-facto D2C channel).

The “Fast Track” regime provides a great managerial pretext for a D2C foray – partner up with a technology company or take a significant minority ownership in a D2C venture.

Examples of the “greenfield challenger” observation:

i. Bowtie – for Sun Life Corporation

ii. Avo – for Asia Insurance Group

iii. ZA Insurance – for Fubon Life

iv. Blue – for Aviva (sadly, not anymore!)

Insurance product innovation

In theory securing an “insurance licence” should allow a company to write “innovative” insurance products. This is true to some extent – however, most new insurance carriers have extensive reinsurance arrangements to maintain capital adequacy until they reach scale. Therefore, the extent of pricing & product innovation is limited by their partner reinsurer’s risk appetite.

In spite of the above constraint, it seems that the virtual insurers are off to a good start – OneDegree is launching a cyber product, Avo Insurance has launched an e-wallet insurance product amongst others.

Lessons for other jurisdictions

Thailand’s insurance regulator – the OIC conducted a feasibility study on the HKIA’s “Fast Track” programme and is considering launching its own digital insurance regime[26]

Getting licenced is hard

I’d imagine some of you might point out a potential disadvantage that virtual insurers are at in Hong Kong – same capital adequacy laws but unable to conduct omni-channel business.

However, leaving aside capital laws, getting a licence is very difficult as an independent company (e.g. OneDegree – see how long it took whilst others with incumbents on the capitalization table had a quicker process; from the outside at least!)

Getting a licence is very hard in some geographies (dare I say impossible) such as India where recent failures have caused the IRDAI to reign back on new licences.

Closing thoughts

Hopefully, this review of the “virtual insurance” regime in Hong Kong has given you some context on the regulatory set-up, an overview of the competitive landscape and some inspiration to explore digital-only insurance challengers in your core market.

As a side note - next week, I’ve got a deep-dive into ZhongAn (~ $2.05bn in revenue in 7 years!)

I look forward to your thoughts, comments and feedback! If you found this useful, please feel free to leave a like!